-

Silicon Valley Bank to Be Acquired by First Citizens After Biggest US Bank Collapse Since 200827 March 2023

Silicon Valley Bank to Be Acquired by First Citizens After Biggest US Bank Collapse Since 200827 March 2023 -

TCS, Infosys Have Highest Exposure to US Regional Banks, Says JP Morgan After SVB Collapse17 March 2023

TCS, Infosys Have Highest Exposure to US Regional Banks, Says JP Morgan After SVB Collapse17 March 2023 -

Indian Startups Have Deposits of About $1 Billion in Silicon Valley Bank: MoS IT Rajeev Chandrasekhar17 March 2023

Indian Startups Have Deposits of About $1 Billion in Silicon Valley Bank: MoS IT Rajeev Chandrasekhar17 March 2023 -

Silicon Valley Bank Resolution Will Bring Relief to Startups in Aftermath of Collapse: Ashwini Vaishnaw14 March 2023

Silicon Valley Bank Resolution Will Bring Relief to Startups in Aftermath of Collapse: Ashwini Vaishnaw14 March 2023

- Home

- Internet

- Internet News

- MoS IT Rajeev Chandrasekhar to Meet Indian Startups to Assess Impact of Silicon Valley Bank's Collapse

MoS IT Rajeev Chandrasekhar to Meet Indian Startups to Assess Impact of Silicon Valley Bank's Collapse

California banking regulators shut down Silicon Valley Bank (SVB) on Friday.

By Reuters | Updated: 13 March 2023 09:50 IST

Photo Credit: Reuters

SVB's failure is the biggest in the US since the 2008 financial crisis

Click Here to Add Gadgets360 As A Trusted Source

Advertisement

India's state minister for technology said on Sunday he will meet start-ups this week to assess the impact on them of Silicon Valley Bank's collapse, as concerns rise about the fallout for the Indian start-up sector.

California banking regulators shut down Silicon Valley Bank (SVB) on Friday after a run on the lender, which had $209 billion (roughly Rs. 17 lakh crore) in assets at the end of 2022, with depositors pulling out as much as $42 billion (roughly Rs. 3.4 lakh crore) on a single day, rendering it insolvent.

"Start-ups are an important part of the new India economy. I will meet with Indian Startups this week to understand impact on them and how the government can help during the crisis," Rajeev Chandrasekhar, the state minister for IT said on Twitter.

India has one of the world's biggest start-up markets, with many clocking multi-billion-dollar valuations in recent years and getting the backing of foreign investors, who have made bold bets on digital and other tech businesses.

SVB's failure, the biggest in the US since the 2008 financial crisis, has roiled global markets, hit banking stocks and is now unsettling Indian entrepreneurs.

Two partners at an Indian venture capital fund and one lender to Indian start-ups told Reuters that they are running checks with portfolio companies on any SVB exposure and if so, whether it is a significant part of their total bank balance.

Consumer internet startups, which have drawn the bulk of funding in India in recent years, are less affected because they either do not have an SVB account or have minimal exposure to it, the three people said.

"Spoke to some founders and it is very bad," Ashish Dave, CEO of Mirae Asset Venture Investments (India), wrote in a tweet.

"Especially for Indian founders ... who setup their U.S. companies and raised their initial round, SVB is default bank. Uncertainty is killing them. Growth ones are relatively safer as they diversified. Last thing founders needed."

Software firm Freshworks said it has minimal exposure to the SVB situation relative to the company's overall balance sheet.

"As we grew, we brought on larger, diversified banks such as Morgan Stanley, JP Morgan and UBS. The vast majority of our cash and marketable securities today is not held at SVB," Freshworks said in a blog post, adding that the company does not foresee any disruption to employees or customers.

Freshworks said it is working with customers and vendors who were using its SVB account to migrate to alternate bank accounts.

India's Nazara Technologies Ltd, a mobile gaming company, said in a stock exchange filing that two of its subsidiaries, Kiddopia Inc and Mediawrkz Inc, hold cash balances totalling $7.75 million (roughly Rs. 63.4 crore) with SVB.

© Thomson Reuters 2023

The Xiaomi 13 Pro has a hefty price tag compared to the company's 2022 flagship model. How does it fare against other high-end phones launched in 2023? We discuss this on Orbital, the Gadgets 360 podcast. Orbital is available on Spotify, Gaana, JioSaavn, Google Podcasts, Apple Podcasts, Amazon Music and wherever you get your podcasts.

Affiliate links may be automatically generated - see our ethics statement for details.

Comments

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

© Copyright Red Pixels Ventures Limited 2026. All rights reserved.

-

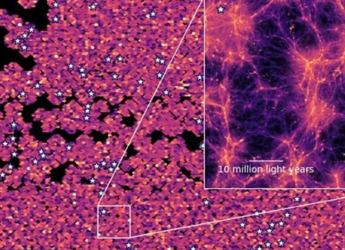

Astronomers Create the Largest 3D Map of the Early Universe’s Hydrogen Glow

Astronomers Create the Largest 3D Map of the Early Universe’s Hydrogen Glow

-

The Boys Season 5 OTT Release: When, Where to Watch the Final Season of the Superhero Series

The Boys Season 5 OTT Release: When, Where to Watch the Final Season of the Superhero Series

-

Laalo – Krishna Sada Sahaayate OTT Release: When, Where to Watch the Gujarati Spiritual Drama

Laalo – Krishna Sada Sahaayate OTT Release: When, Where to Watch the Gujarati Spiritual Drama

-

Vikram On Duty OTT Release: When, Where to Watch Nikhil Maliyakkal’s Telugu Crime Thriller

Vikram On Duty OTT Release: When, Where to Watch Nikhil Maliyakkal’s Telugu Crime Thriller