Paytm Wins RBI Extension for Payment Aggregator Licence Application: Details

Paytm says it aims to reapply for a payment aggregator licence in 15 about days.

Photo Credit: Reuters

Paytm said that the latest move has no material impact on its business and revenue

Indian financial technology company Paytm Payments Services has received an extension from the country's banking regulator to apply for a payment aggregator licence and aims to reapply in about 15 days, the company said on Sunday.

Paytm Payments Services, in the meantime, can continue with the online payment aggregation business for its existing partners, without taking on any new merchants, the company said in a notification to stock exchanges on Sunday.

Paytm Payments Services is a wholly owned subsidiary of One 97 Communications.

Payment aggregators, platforms that bring together various online payment options, must be licensed by India's central bank and banking regulator, Reserve Bank of India.

In November, India's banking regulator had declined a payment aggregator licence for the One 97 Communications unit that owns the popular Paytm brand.

The company said that the latest move has no material impact on its business and revenue and for the offline part of the business, the company can continue to take on new merchants and offer them payment services.

Last month, Paytm said EBITDA (earnings before interest, taxes, depreciation, and amortisation), an indicator of operational profit, before ESOP cost margin improved to Rs. 31 crore during the third quarter ended December 31, 2022.

The company has calculated an incentive of Rs. 130 crore from UPI transactions in three quarters but CEO Vijay Shekhar Sharma said that the incentive may technically make the fourth quarter a free cash flow positive quarter but Paytm will report as a one-time item.

"UPI incentive will be one-off and we will explicitly call out as one-off. Rs. 130 crore that we are quoting is for three quarters. The fourth quarter number will be topped on top of it. Because we are calling it one-time item, we are not calling it free cash flow generative. We would rather say free cash flow generative when we are consistently sure of it," Sharma said during the earnings call in February.

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Realme Note 80

- Vivo V70 FE

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

-

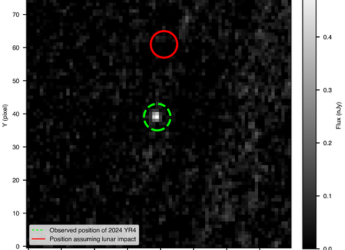

NASA’s Webb Telescope Confirms Asteroid 2024 YR4 Will Safely Pass the Moon in 2032

NASA’s Webb Telescope Confirms Asteroid 2024 YR4 Will Safely Pass the Moon in 2032

-

ChatGPT Adult Mode Delayed Again as OpenAI's 'Code Red' Reportedly Ends

ChatGPT Adult Mode Delayed Again as OpenAI's 'Code Red' Reportedly Ends

-

Lava Bold 2 5G India Launch Date Announced; Confirmed to Feature Under-Display Fingerprint Scanner

Lava Bold 2 5G India Launch Date Announced; Confirmed to Feature Under-Display Fingerprint Scanner

-

Realme Note 80 Launched With 6,300mAh Battery, 6.74-Inch Display: Price, Specifications

Realme Note 80 Launched With 6,300mAh Battery, 6.74-Inch Display: Price, Specifications