- Home

- Internet

- Internet News

- Paytm Gets Fresh Funding From Alibaba, Ant Financial

Paytm Gets Fresh Funding From Alibaba, Ant Financial

Alibaba and Paytm disclosed the deal in a joint statement on Tuesday without saying how much it is worth, nor how big a stake in Paytm the Chinese firms will acquire.

Ant Financial already acquired 25 percent of Paytm parent One97 Communications in February in a transaction that a person with knowledge of the matter said was worth more than $500 million (roughly Rs. 3,100 crores).

In June, Reuters reported that Alibaba Group was in advanced talks to buy a stake in Paytm, according to two people familiar with the matter.

At the time, one source with direct knowledge said the deal would see Alibaba directly invest around $600 million (roughly Rs. 3,800 crores). That would see it and affiliated Ant Financial's total holding amount to about 40 percent of the Indian payments firm, and value Paytm at roughly $4 billion (roughly Rs. 26,400 crores).

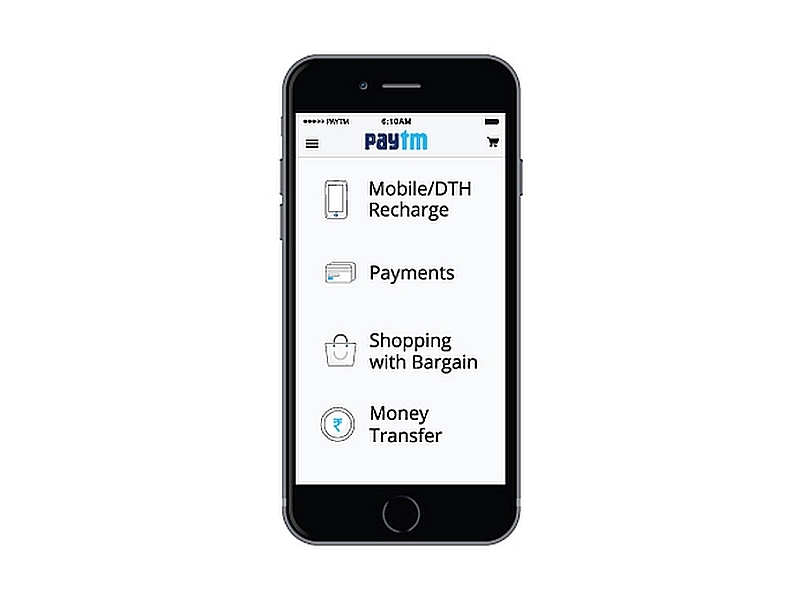

In their statement on Tuesday, the companies said the new funds will help Paytm expand its mobile commerce and payment system in India, as well as invest in marketing, technology and talent. Paytm currently has more than 100 million Paytm Wallet users who carry out over 75 million transactions a month, according to the statement.

© Thomson Reuters 2015

Disclosure: Paytm founder Vijay Shekhar Sharma's One97 is an investor in Gadgets 360.

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Realme 16 5G

- Redmi Turbo 5

- Redmi Turbo 5 Max

- Moto G77

- Moto G67

- Realme P4 Power 5G

- Vivo X200T

- Realme Neo 8

- HP HyperX Omen 15

- Acer Chromebook 311 (2026)

- Lenovo Idea Tab Plus

- Realme Pad 3

- HMD Watch P1

- HMD Watch X1

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)