FreeCharge Partners Yes Bank, Fino PayTech to Launch Wallet Solution

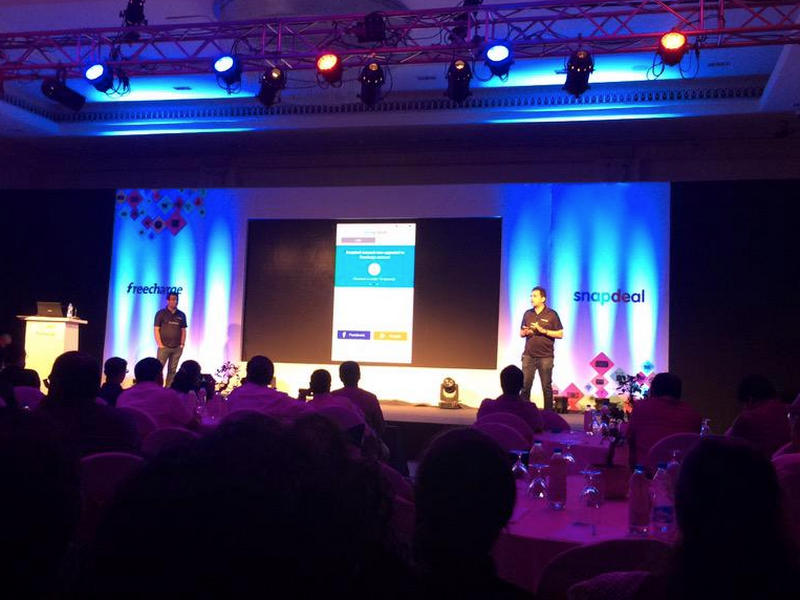

Snapdeal-owned mobile transactions platform FreeCharge announced its foray into the wallets space in Bengaluru on Tuesday.

FreeCharge has partnered with Yes Bank and payment bank licensee Fino PayTech to launch the service, which will go live in a few weeks. The company claims that its wallet is able to reduce checkout times to under 10 seconds.

"At Snapdeal we are building an ecosystem that powers billions of digital commerce transactions. With the launch of the FreeCharge Digital Wallet, we will now play an even more intrinsic role in our customers' lives," Kunal Bahl, CEO and co-founder, Snapdeal said.

Kunal Shah, CEO and co-founder, FreeCharge, said that the wallet was equipped with state of the art technology and a robust partner network, "making it a truly game-changing service that will bring value to consumers and our partners in the ecosystem."

FreeCharge said that its platform has 27 million registered users making more than 5 transactions per month per user, 8.2 million daily unique users, 4 million monthly engaged hours, 15 million stored cards, with combined with GMV of over $4 billion (roughly Rs. 26,543 crores). Over 90 percent of its transactions are from mobile devices, accounting for a volume of over 200 million transactions annually.

Anand Chandrasekharan, Chief Product Officer at Snapdeal compared the synergy between the two firms to eBay and PayPal, Taobao and Alipay.

While FreeCharge already has a credit-based wallet-like feature in its app called 'FreeCharge Credits', that gets credited when a transaction is unsuccessful. By partnering with a payment bank licensee, FreeCharge can integrate the wallet with savings bank accounts via IMPS and NEFT transfers and issue ATM and debit cards.

(Also read: What Are Payment Banks, What They Can and Cannot Do, and Who Will They Affect?)

Flipkart is reportedly planning to launch a payment service on its mobile apps in the next three months, and had paid around Rs. 45.4 crores to acquire a majority stake in payments firm FX Mart, which owns a prepaid license issued by Reserve Bank of India (RBI).

Cab aggregator Ola had announced plans to integrate its mobile wallet with Oyo Rooms, Lenskart, Saavn, among other startups.

According to Tracxn, some of the top top funded players in the mobile wallets space are Paytm, which has raised $585 million (roughly Rs. 3881 crores); MobiKwik, which has raised $30.25 million (roughly Rs. 197 crores); PayMate, which has raised $14 million (roughly Rs. 91 crores); MoneyOnMobile, which has raised $10 million (roughly Rs. 65 crores), and CitrusPay, which raised $7.5 million (roughly Rs. 48 crores).

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Apple iPhone 17e

- AI+ Pulse 2

- Motorola Razr Fold

- Honor Magic V6

- Leica Leitzphone

- Samsung Galaxy S26+

- Samsung Galaxy S26 Ultra

- Samsung Galaxy S26

- Asus TUF Gaming A14 (2026)

- Asus ProArt GoPro Edition

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Apple iPad Air 13-Inch (2026) Wi-Fi

- Huawei Watch GT Runner 2

- Amazfit Active 3 Premium

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)