- Home

- Cryptocurrency

- Cryptocurrency News

- Bitcoin Nears $110,000 as Whale Moves and ETF Flows Shape Market

Bitcoin Nears $110,000 as Whale Moves and ETF Flows Shape Market

Bitcoin struggles around the $110,000 (Rs. 96.8 lakh) mark, while Ethereum eyes $4,600 (Rs. 4.05 lakh) amid shifting crypto sentiment.

Photo Credit: Unsplash/TabTrader_com

Bitcoin trades near $110,000 while Ethereum ETFs signal strong institutional demand

The global crypto market appears to be making cautious moves this week, and Bitcoin (BTC), the world's oldest cryptocurrency, was trading around $110,000 (roughly Rs. 96 lakh) on Tuesday, slightly down over the past 24 hours, as per CoinMarketCap. Ethereum (ETH) showed consistency as it was trading at $4,312 (roughly Rs. 4 lakh). Analysts highlighted that the $105,000-$108,000 range has become a crucial support for BTC. The current $110,000 price was a key level to be reclaimed, as September has proven to be a historically weaker month for Bitcoin.

Altcoins Show Stability As Ethereum ETFs Surge Amid Bitcoin Volatility

Among altcoins, Solana (SOL) is at $203 (roughly Rs. 17,900), Dogecoin (DOGE) is stable at $0.21 (roughly Rs. 18), XRP traded at $2.87 (roughly Rs. 250), and Binance Coin (BNB) hovered at $856 (roughly Rs. 75,400). Market observers pointed out that even though Bitcoin struggles to gain momentum, institutional inflows into ETH ETFs have created cautious optimism for altcoins.

Avinash Shekhar, Co-Founder and CEO of Pi42, underlined growing caution despite institutional support. “Bitcoin is holding near $110,000, but the footing looks fragile as whales shuffle positions and on-chain flows raise caution. Yet beneath the surface, institutional appetite remains resilient US spot ETFs saw fresh net inflows, and Japan's Metaplanet lifted its holdings past 20,000 BTC, reinforcing long-term conviction. The market is also bracing for a potential ‘Red September.” He noted that Ethereum and Solana are quietly gaining traction, while XRP consolidation may precede a breakout.

The CoinSwitch Markets Desk also highlighted the growing shift in capital flows. “A Bitcoin whale worth over $11 billion sold another $215 million (roughly Rs. 18,920 crore) worth of Bitcoin to buy $216 million (roughly Rs. 19,010 crore) worth of spot ETH,” it said, adding that the move strengthens Ethereum's case as an institutional asset, while reflecting a broader rotation into altcoins.

“Bitcoin exchange reserves have dropped to a seven-year low, signaling strong investor conviction and easing immediate sell-side pressure. On the other hand, Ethereum is trading in a tight range around $4,300 as whale inflows are yet to contribute to the price action,” said Edul Patel, CEO of Mudrex, who pointed to encouraging signs beneath the surface.

Despite the short-term market sentiment being cautious, Japanese company Metaplanet added 1,004 BTC worth $112 million (about Rs. 9,860 crores), bringing its total to 20,000 BTC holdings.

For now, traders will keep a watchful eye on whether Bitcoin can reach $115,000 (roughly Rs. 1.01 crore) or if fresh weakness drags it backwards, to $100,000 (roughly Rs. 88 lakh). Ethereum reclaiming $4,600 (roughly Rs. 4.05 lakh) will be crucial in building broader sentiment.

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Apple iPhone 17e

- AI+ Pulse 2

- Motorola Razr Fold

- Leica Leitzphone

- Samsung Galaxy S26+

- Samsung Galaxy S26 Ultra

- Samsung Galaxy S26

- iQOO 15R

- Asus TUF Gaming A14 (2026)

- Asus ProArt GoPro Edition

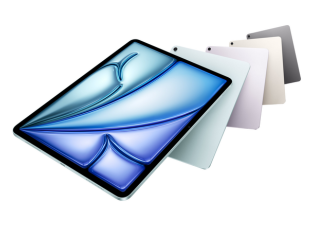

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Apple iPad Air 13-Inch (2026) Wi-Fi

- Huawei Watch GT Runner 2

- Amazfit Active 3 Premium

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)